We recently made some changes to the marketplace that gives buyers the ability to make offers and request more information directly on the platform. We needed to store these actions in our database for functionality purposes, but one thing we didn’t realize was the amount of value this new data set would create. Prepare to be amazed.

If you asked us for the average offer price on Outdoor flower on the wholesale market, I can now give you an exact number which is $0.335/g. I can also give you an average acceptance price ($0.43), the average asking price ($0.45), the max buyer interest price ($0.43), and the average asking price of products that had inquiries but not necessarily an offer ($0.42). These are all averages, but we also have the median price, max price, min price, and weighted averages based on weight.

What’s amazing is we can do this for every product type in the system and use these numbers to forecast trends and provide real-time market rates. If we take this one step further, we have a vision of being able to use machine learning to help guide buyers and sellers. This means upon product upload we would should be able to provide useful stats and estimates such as:

- Recommended Listing Price

- Estimated Number of Buyer Inquiries per Product

- Estimated Time Range to Close

- Estimated Closing Price

- And Many More

The computers are much smarter than us when it comes to data analysis, but until we build these predictive models I have some insights to report!

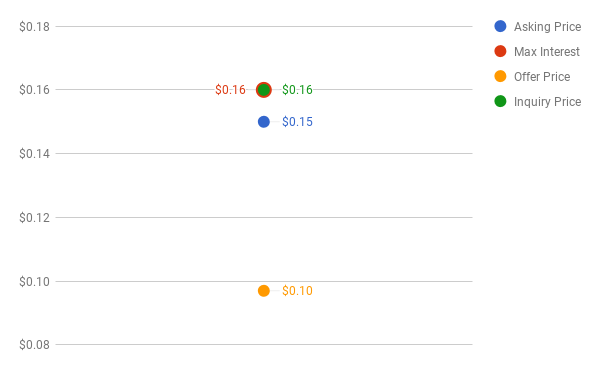

Outdoor Trim Price Analysis

(This data set was created using +3600lbs of trim sales made through Kush Marketplace since May 1st)

Average Asking Price: $0.15/g

Average Max Interest: $0.16/g

Average Offer Price: $0.097/g

Average Inquiry Price: $0.16/g

The marketplace is working! Sellers are doing a great job of pricing trim close to the peak of max interest price and optimizing for the best price on their trim. We’re really proud that this has happened especially considering the volume of trim transactions happening on the marketplace. I have confidence that we play a role in standardizing wholesale prices across product categories. The truth about trim right now is that there is only so much of it out there. As extraction companies scale their businesses, their raw material needs increase. Their success is good for the industry because more demand than supply drives up price.

Once concern for sellers is if you price over the max interest price you run the risk of not notifying all buyers through the buyer notifications they set up in their saved searches. If you want to make a sale, price your trim as close to it’s real value as possible. If you’re comfortable with $0.08/g, price your trim at $0.11/g for the maximum opportunity to sell. The closer you are to the final price, the more bids you will have on your material.

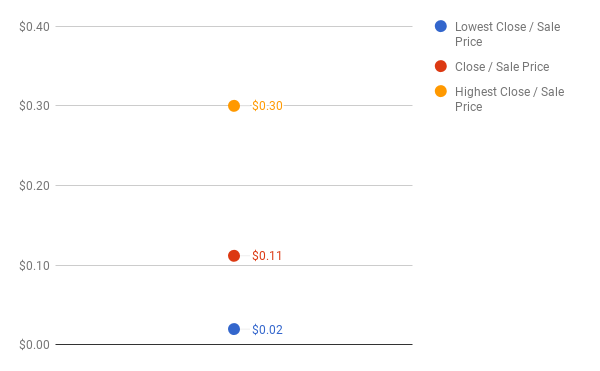

Average Sale price is $0.11/g (Below), average offer is $0.10/g, and average asking is $0.15/g. These numbers are important because the average move from asking to sale is 26%. We’re curious to see where this number goes as the market becomes more efficient through the marketplace!

Lowest Close / Sale Price: $0.02/g

Lowest Close / Sale Price: $0.02/g

Average Close / Sale Price: $0.1119/g

Highest Close / Sale Price: $0.30/g

(The highest close was tested trim/popcorn ready for prerolls)

Last month we were wrong about final trim prices dropping to sub $0.05/g. Instead they have stabilized because demand has dramatically increased on the platform. Additionally, planting season has officially started for next fall’s harvest, and trim / extraction material sales are up significantly because many farms have started accruing the expenses associated with their next harvest. It’s time to offload trim and last year’s material because as soon as the early harvests start coming down, year old material prices drop. If you’re a seller, now is the time to upload your material using your product manager.

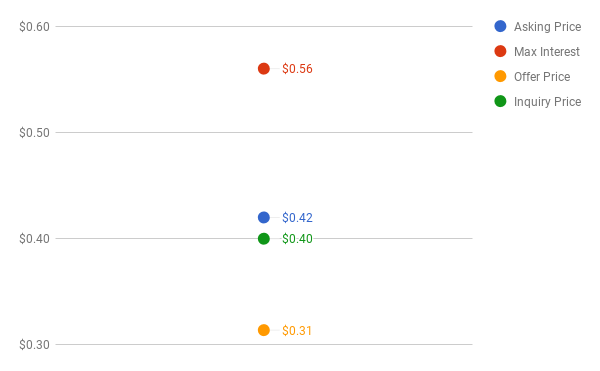

Indoor / Greenhouse Trim Price Analysis

(This data set was created using around 150lbs of trim sales made through Kush Marketplace since May 1st)

Average Asking Price: $0.42/g

Average Max Interest: $0.56/g

Average Offer Price: $0.314/g

Average Inquiry Price: $0.40/g

Demand for indoor & greenhouse trim has slumped because of the flood on outdoor raw material. These trim prices have been maintained because most indoor trim that sells has test results associated with it in the traceability system. To maximize price, make sure there are test results associated with your trim so that it can be bought and use in joints. Many indoor trim buyers also buy popcorn from the same farms so building those relationships through the marketplace can be quite fruitful month after month.

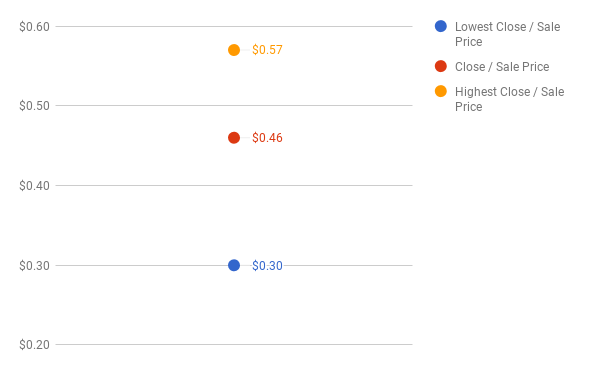

Lowest Close / Sale Price: $0.30/g

Average Close / Sale Price: $0.46/g

Highest Close / Sale Price: $0.57/g

Indoor trim prices have been stable since we started tracking transactions on the marketplace. It’s typically $0.50/g for trim that has test results above 20% THC, $0.35/g for trim with test results from 16-18% THC, and in the $0.20 range for untested or tested below 16%. We expect this price to stay stable or increase slightly over the next month as outdoor trim gets depleted and extractors need to convert from outdoor trim to outdoor flower or indoor trim for extraction.

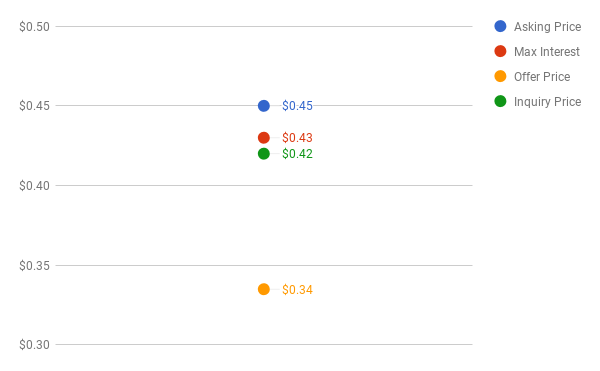

Outdoor Flower Price Analysis

(This data set was created using around 1,500lbs of flower sales made through Kush Marketplace since May 1st)

Average Asking Price: $0.45/g

Average Max Interest: $0.43/g

Average Offer Price: $0.335/g

Average Inquiry Price: $0.42/g

Average asking ($0.45) and average close ($0.43) are right on the money! Again, we’re proud to see these numbers aligning so well. It’s easy for farms to see the marketplace and compare their inventory to other available inventory.

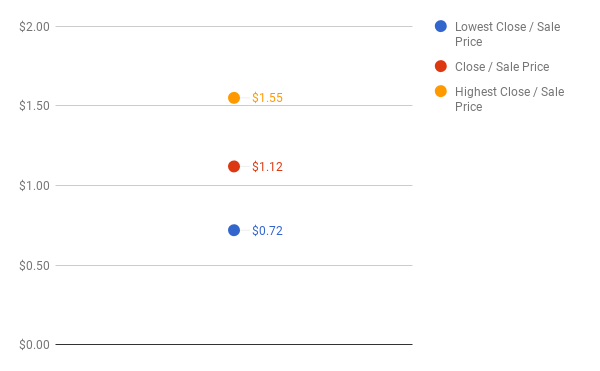

Lowest Close / Sale Price: $0.16/g

Average Close / Sale Price: $0.43/g

Highest Close / Sale Price: $0.62/g

The lowest close was obviously for extraction. Outdoor flower for extraction has typically settled between $0.25/g and $0.33/g depending on how trimmed the flower is and the size of the bud. Trimmed and tested flower has averaged out around $0.50/g range, but there are sales happening as high as $0.62/g but in these market conditions this price is kind of a rarity.

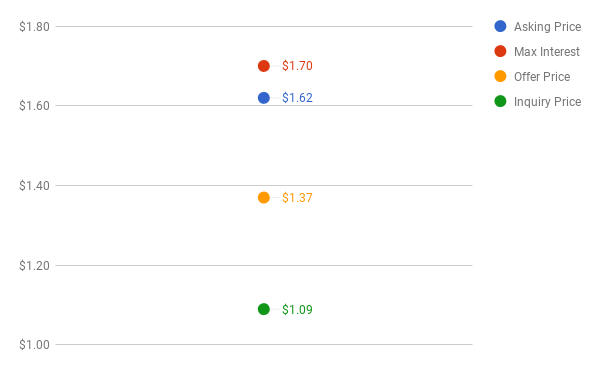

Indoor Flower Price Analysis

(This data set was created using less than 100lbs of flower sales made through Kush Marketplace since May 1st)

Average Asking Price: $1.62/g

Average Max Interest: $1.70/g

Average Offer Price: $1.37/g

Average Inquiry Price: $1.09/g

Indoor flower sales are tough in the current market conditions. A couple of new large indoor production facilities have come online recently. These farms are impacting the market to retail, and the price is pushing lower. These lower prices impact sales to retail which effects wholesale buyer interest. Additionally, outdoor flower continues to flood the market. We expect indoor sales to pickup as we move further into June and July. The outdoor inventory dumps are starting to slow. The outdoor price drop and the encouraged large wholesale purchases. Now bulk outdoor inventory is starting to dry up which could drive prices up across the board. This would not be a bad thing for the industry.

Lowest Close / Sale Price: $0.72/g

Average Close / Sale Price: $1.12/g

Highest Close / Sale Price: $1.55/g

A-grade bud was much easier to sell at $1.40 3 months ago. Now it can sit on the marketplace at $1.25 with inquiries but no one pulling the trigger. I think this is temporary, but we will be tracking these prices over the next couple of months!

Final Notes:

I also look forward to hearing your comments and seeing everyone at our event on Wednesday. We have well over 100 retail shops planning to attend, and more than 50 vendor booths showing off the best products the industry has to offer!